The Cutting Edge of Medical Technology Content, Community & Collaboration

Aung Kyaw Moe and Jun Hasegawa have a lot in common.

Both are entrepreneurs. Both left home to seek their fortunes. Both are now working on digital-payment projects with operations in Southeast Asia.

But when it came to collecting money to fund their startups, they took opposite paths. Aung, 42, is raising as much as $30 million in venture capital with the goal of perhaps going public in a few years. Hasegawa, 36, brought in $25 million through a so-called initial coin offering, an unregulated sale process that’s exploded in popularity in the last year. His company’s tokens, OmiseGO, are already worth more than $2 billion.

“It’s been crazy,” says Hasegawa, co-founder and chief executive officer of the startup Omise. “It took only six months to get here.”

Aung watched Omise’s rocket ride with wonder and a touch of envy. Should he try an ICO too? While venture money can be harder to get, he ultimately decided on that route and said ICOs are too shaky a foundation to build a business on.

“If it all came crashing down one day, you would have no control,’’ said Aung, whose startup is called 2C2P, for Cash and Card Payment Processor. “I like to go to bed with peace of mind.’’

The rivals illustrate a dilemma startups are now facing the world over. Should they pursue traditional venture capital with its predictability and limitations or turn to ICOs where there is quick money, volatility and innumerable unknowns?

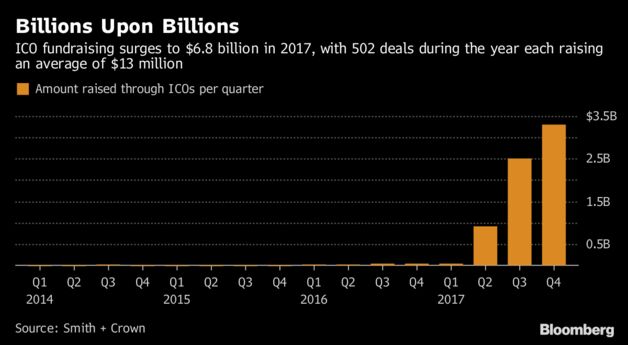

ICOs are winning support with fundraisings jumping to more than $6.8 billion in 2017, up from $151 million in 2014, 2015 and 2016 combined, according to research firm Smith + Crown. Telegram Inc., an encrypted messaging service, is planning to raise at least $1.2 billion through an initial coin offering, which would be by far the largest ever. Many people buy into ICOs for a simple reason: The coins have soared in the past year, driven in part by a surge in Bitcoin of more than 10 fold.

Omise and 2C2P took different routes to their decisions. Aung, a Myanmar-born computer programmer, founded his startup in 2003 in Bangkok. He helps customers like Thai Airways, Lazada and Zara handle online payments with credit or debit cards — or cash payments at convenience stores from people without bank access.

The Japanese Hasegawa and Thai co-founder Ezra Don Harinsut started Omise in Bangkok a decade later as an e-commerce firm, then pivoted to payments. Their OmiseGO network aims to let anyone carry out financial transactions with cryptocurrencies such as ethereum and Bitcoin, as well as fiat money like the dollar. They want to move people from traditional banking into the decentralized world of digital currencies.

They may not have been able to raise venture money even if they tried — their crypto service hadn’t launched last year when they were seeking funds. The ICO was also easier because they didn’t have to give up equity in the company. People who buy OmiseGO tokens — or just OMG — don’t get shares in Omise; rather they get currency they’ll be able to use on the company’s network.

Hasegawa said some of his existing investors were reluctant to back the project. But because the company wasn’t selling equity, they didn’t need shareholder signoff. They posted the ICO whitepaper — essentially a fundraising plan — online in June without any detailed financials. A few weeks later, they had more than enough interest.

“When we told them we got more than $200 million in commitments, they were like, ‘Whaaaat?,’” said Hasegawa. Omise owns 30 percent of the tokens, now worth more than $500 million.

The ICO money was aimed at helping the company launch an ethereum-based technology for digital wallets by the fourth quarter, but the project hasn’t started yet. Hasegawa says a limited version of the network is on track for mid-2018.

Read more for further details http://snip.ly/bpymm

Views: 8

Comment

© 2025 Created by CC-Conrad Clyburn-MedForeSight.

Powered by

![]()

You need to be a member of MedTech I.Q. to add comments!

Join MedTech I.Q.